The Deadly Wisdom of Economics

Why Neoclassical economists know nothing about the impact of less energy availability on GDP

Steve Keen

The Ukraine War has emphasised Western Europe’s dependence upon Russian energy exports, and a group of mainstream economists decided to consider what might happen to the German economy if Russia effectively reduced the supply of energy to Germany by 10%.

Their conclusion, in a working paper entitled “What if? The macroeconomic and distributional effects for Germany of a stop of energy imports from Russia” (in German, with an English appendix), was comforting: a 10% fall in energy would only reduce GDP by one sixth as much: “economic losses from a -10% energy shock could be up to 1.5% of German GNE … GNE losses of an embargo on Russian energy are small.” (Bachmann et al. 2022a, pp. 2,8).

In a Vox editorial, Bachmann and his co-authors observed that there had been “Public fear-mongering about the catastrophic consequences of an energy embargo from lobby groups and affiliated think tanks”. But they rejected this “fear mongering” because it “does not hold up to academic standards” (Bachmann et al. 2022b).

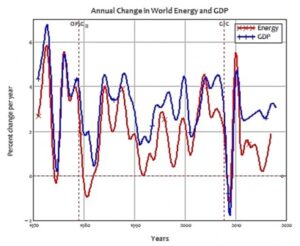

Which is a pity, because the empirical data shows that, at the global level, the relationship between changes in energy and changes in GDP is 1:1. Figure 1 plots the annual change in energy against the annual change in global GDP between 1970 and 2017, and one fits the other like a glove. If energy falls by 10%, then on the historical record, GDP will fall by the same amount.

So who are you going to trust—the empirical evidence, or assurances from mainstream economists which contradict the empirical evidence?

This situation reminds me of the old Marx Brothers line “who are you going to trust? Me, or your lying eyes?”, and the comment about economists by a former chair of the US President’s Council of Economic Advisers, Walter Heller, that “An economist is someone who says, when an idea works in practice, ‘let’s see if it works in theory.'”

Bachmann rejected the assertion—which is borne out by the empirical data—that the relationship between energy and GDP could be one for one, on the basis of mainstream economic theory: if mainstream theory applies in reality, then the relationship between energy and GDP could not be one for one. He put it this way (I’ll explain the jargon—highlighted in italics below—shortly):

If factors markets are competitive so that factor prices equal marginal products, this then implies that similarly the price of energy jumps to 1/a and the prices of other factors fall to zero… this then also implies that the expenditure share on energy jumps to 100% whereas the expenditure share on other factors falls to 0%. We consider these predictions to be economically nonsensical.

I do too—but that’s because Neoclassical theory is nonsensical. The next paragraph explains the jargon. Don’t worry if you don’t quite understand it—frankly, you’ll have more trouble coping with reality if you do understand it!

“Factor markets” mean the markets that set the wage rate for workers and the profit rate for capitalists. “Competitive” means that there are no unions or employer associations involved in wage bargaining or price setting. “Factor prices” means wages and the rate of profit. “Marginal products” means the amount that the last worker (or last machine) adds to output—if the last worker hired increases output by $1000 a week, then the wage for all workers will be $1000 a week. The Greek symbol “a” represents the fraction of GDP that is involved in the production of energy, and it’s just 4%.

The rest of the paragraph states that, according to Neoclassical theory, if these assumptions were true, and the Neoclassical model of production and distribution is correct, and there was a 1:1 relationship between change in energy and change in GDP, then all of GDP would be spent buying energy, and wages and profits would be zero.

Since these last two results are obviously false—wages and profits aren’t zero, and spending on energy isn’t equal to GDP—Bachmann concluded that therefore, there could not be a 1:1 relationship between change in energy and change in GDP.

Only there is, as Figure 1 makes abundantly clear! So, something else must be wrong. The only two choices are (a) the assumption that “factor markets are competitive” is false, and (b) the model of production and distribution that mainstream economists use is false.

In fact, both are false—but the first is much less important than the second. There are unions involved in setting wages, but unions are much weaker now than they were forty years ago, so maybe you could pretend that the labour market is “competitive”.

The real problem though, is the Neoclassical theory of production and distribution. It has more holes in it than a Swiss cheese, so I can’t cover them all here (I’ll discuss them in more detail in a technical post). The key one for this paper is that the Neoclassical model assigns a trivial role for energy in production. Bachmann notes that in the simplest version of the model, the so-called “Cobb-Douglas Production function … a drop in energy supply of … 10% … reduces production by … 0.4%”.

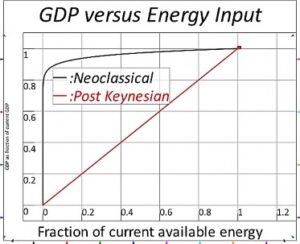

This is illustrated in Figure 2, versus the situation he derides—but which actually applies in reality—of a 1:1 relationship between energy input and GDP output.

Bachmann focuses on the predictions, from Neoclassical production theory, of the impact of a 10% fall in energy input—which the standard “Cobb Douglas Production Function” predicts would lead to a truly trivial 0.4% fall in GDP. But even a huge reduction in energy—an 80% fall—would, according to the Cobb Douglas Production Function, cause a fall in GDP of less than 10%.

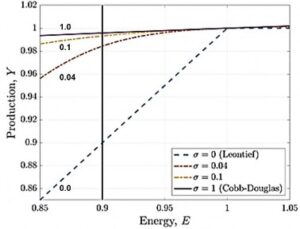

He considers a more complicated form (the “CES” or “constant elasticity of substitution” version) where a lower level of substitution can result in a higher impact on GDP from a fall in energy inputs. In the CES function, the parameter sigma (s) represents the ease with which inputs (in this simple model, Labor, Capital, and Energy) can be substituted for one another. returns the so-called “Leontief Production Function”, which is the workhorse of Post-Keynesian economics, in which the relationship between energy and GDP is 1:1, as shown in the empirical data (the standard model has a 1:3 relationship between capital and GDP, which I’ve shown elsewhere reflects the amount of energy used in production that is turned into useful work); 1 returns the standard Cobb-Douglas Production Function.

However, as Bachmann remarks, even the slightest increase above zero in the degree of substitution returns something very close to the raw Cobb-Douglas form:

Somewhat more interestingly, even though both of these two elasticities and are numerically close to zero, the figure reveals that the implications for the dependence of production on energy are potentially quite different from the Leontief case with: even the case lies considerably closer to the Cobb-Douglas case than the Leontief case (my emphasis).

Despite this insight, he later picks the case as his best guess of the impact of losing 10% of German energy supplies on German GDP, and trumpets how this predicts a small impact on GDP, even with “a very low elasticity of substitution”:even in the case of an extreme scenario of cutting all Russian energy imports and not being able to substitute for any of them and an extreme tripling in the share of energy imports (which reflects a very low elasticity of substitution), the GNE loss would only be 1.5%.

This is sheer nonsense. In the real world, energy is critical, in the manner that Bachmann accidentally stumbles upon as he tries to make sense of the Leontief model—which, as Figure 1 confirms, fits the empirical data very well—while still thinking like a Neoclassical economist:

Intuitively, the Leontief assumption means that energy is an extreme bottleneck in production: when energy supply falls by 10%, the same fraction 10% of the other factors of production X lose all their value (their marginal product drops to zero) and hence production Y falls by 10%.

Well duh! Yes of course energy is “an extreme bottleneck in production”. Energy enables workers and machines to turn raw materials into useful products, and without energy, nothing will happen. As I put it in an academic paper, “labour without energy is a corpse; capital without energy is a sculpture” (Keen, Ayres, and Standish 2019). You also can’t substitute for energy: if you don’t have energy, then you can’t use something else to make the machines work.

Ironically, since the model of production that Bachmann derides fits the empirical data so well, what Bachmann has inadvertently done is prove the Neoclassical model of production and distribution is false.

Practically, this means that, if Russia does block energy supplies to Germany, there will be a substantial fall in German GDP. And in general, if a Neoclassical economist predicts something, expect the opposite.

References

Bachmann, Rüdiger, David Baqaee, Christian Bayer, Moritz Kuhn, Andreas Löschel, Benjamin Moll, Andreas Peichl, Karen Pittel, and Moritz Schularick.

2022a. ‘Was wäre, wenn…? Die wirtschaftlichen Auswirkungen eines Importstopps russischer Energie auf Deutschland; What if? The macroeconomic and distributional effects for Germany of a stop of energy imports from Russia’, ifo Schnelldienst, 75.

2022b. “What if Germany is cut off from Russian energy?” In Vox EU.

Keen, Steve, Robert U. Ayres, and Russell Standish. 2019. ‘A Note on the Role of Energy in Production’, Ecological Economics, 157: 40-46.