Government budget deficits and the national debt

John Hermann

The claim of the current Australian federal government that there is a public debt crisis and that there has been a ‘budget emergency’, along with its subsequent program of austerity budgeting and its drive to achieve ongoing budget surpluses, reveals that its members either do not have a grasp of sound macroeconomic principles, or that they are disingenuous and have a hidden agenda, or conceivably both.

Whatever the truth, we recognise a range of myths and fairy stories about federal government deficits and debt which have been falsely presented as facts. Regrettably, the opposition party is little better in its understanding of real world economics. Both major party groupings are obsessed with the objective of achieving and maintaining budget surpluses, which they seem to regard as a measure of fiscal rectitude. The purpose of this article is to provide a reality check.

Australia’s public debt is far smaller than its private debt

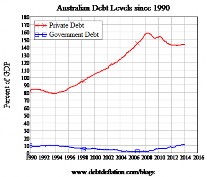

In order to gain a realistic understanding of Australia’s debt position, it is helpful to examine the available debt statistics. Figure 1 is a comparison of the aggregate of private debt (mainly a conjunction of mortgage debt, credit card debt and private corporate debt) and federal government debt (i.e. the stock of privately-held government securities), from 1995 to the present. The statistics have been extracted from the blog-site of Prof Steve Keen [1], and were obtained from figures issued by the Audit Commission and Reserve Bank of Australia. Australia’s current (2014) private debt exceeds seven times government debt (eight times using figures provided by the Bank of International Settlements [2]).

Fig 1. Comparison of Australian government debt (securities held by the private sector) and private debt -1955 to present.Clearly, the overall trend for government debt (aka Treasury securities) over this time-span is a gradual decline in magnitude (as a percent- age of GDP), while the overall trend for private debt has been a large increase in magnitude.[su_divider top=”no” size=”0″ margin=”20″]

Australia’s public debt relative to other countries

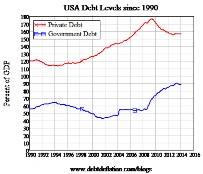

Figures 2(a) and 2(b) compare the changes in private and government debt for Australia and the U.S. over the shorter time-span from 1990 to the present [3]. For both countries we see that government debt tended to fall as private debt grew in the period before the global financial crisis of 2007-8, and that these changes were reversed in the period after it. Also noticeable is the fact that Australian government debt was always around one seventh (or less) of U.S. government debt, as a fraction of GDP.

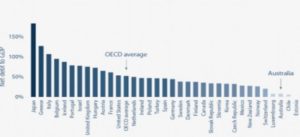

And we also know that Australian government debt is one of the lowest in the world, relative to GDP. This feature of our economy is apparent from an examination of the net debt to GDP ratio for a range of countries, as depicted in the bar chart (Figure 3).[su_divider top=”no” size=”0″ margin=”20″]

[su_divider top=”no” size=”0″ margin=”20″]Central government is different

The freedoms and constraints which apply to any central government which creates and issues the nation’s currency and has a floating currency exchange rate (sometimes described as a sovereign government) are quite different from those which apply to the lower levels of government, to households, and to the private sector more generally. Unlike the latter categories, we know that a currency issuing central government (CICG) may run a budget deficit in perpetuity, even a very large deficit, without any crisis eventuating.

It should be noted that the governments of those countries making up the Eurozone, as well as the governments of the individual states and territories of Australia and North America and the provinces of Canada, are not currency-issuing bodies and so are more constrained than are their respective central governments. For these lower levels of government it is true to say that they should aim for balanced budgets in which their revenue equals their spending, as a long-term average.

Interest on public debt

It is a myth that taxpayers fund the interest payments on a CICG’s public debt, notwithstanding that interest is a budgeted item. That is, these interest payments should not be seen as being funded from tax ‘revenue’. One way of viewing the situation is to regard the interest payments as being effectively factored in as a small component of the issue of future securities. Such securities may always be rolled over – in perpetuity – because a CICG has an unlimited ability to issue Treasury securities at a price ensure their purchase.

In like manner, a CICG’s central bank has unlimited liquidity, i.e. can always create state fiat money (currency and banking reserves) in the process of buying Treasury securities from the private sector at an offered price which ensures their sale. In principle, these CICG securities and state fiat money are interchangeable entities.

Taxes destroy spending power

More generally, the insights provided by modern monetary theory (MMT) reveal that taxpayers don’t actually fund anything associated with CICG spending. If it wishes to, a CICG can behave as if the taxes it imposes on its citizens are recycled for spending purposes, and most governments find it convenient to present this image to its taxpayers. However, the reality is that the taxes imposed by a CICG exist primarily to destroy private- sector spending power in sufficient volume to nullify the inflationary effects of its own spending.

When a CICG taxes the private sector, the spending power destroyed in this process simply goes out of existence. Putting it another way, the money received from taxation is not stored anywhere as useable money, and the money supply is technically reduced with each repayment of CICG tax. In this context, it should be noted that a range of strategies have been devised by different countries for minimising short-term fluctuations in both the money supply and banking reserves. This destruction of spending power by a CICG complements its ability create spending power out of nothing (and as much as it likes, and whenever it likes) for its own spending purposes.

The purpose of Treasury securities

The unlimited capacity of a CICG to find spending power to pay for real goods and services extends to any outstanding public debt it may have, and so it may be argued that a CICG has no real debt at all. A debt which never needs to be paid back because the borrower has unlimited spending power and may roll it over forever, and because the borrower has an unlimited capacity to pay any interest owed, is effectively not a debt at all.

The sale of bonds and other Treasury securities by a CICG also should not be placed in the same category as private debt because a CICG does not actually need to finance a budget shortfall. Apart from providing the private sector with risk-free financial assets, the primary purpose of issuing Treasury securities is to provide the central bank with the means to drain excess bank reserves created when a CICG operates a budget deficit (which equates to a net injection of spending power into the economy), thus allowing the central bank to set and defend a target short-term interest rate.

Moreover, the financial system and large investing bodies (institutional investors like pension funds and mutual funds) have an absolute need for zero-risk government securities, in order to adequately carry out their risk management and liquidity management. To remove this form of government debt is to deprive those bodies of an adequate mix of financial investments embracing high risk, medium risk and low (or zero) risk.

The ‘crowding out’ theory

The argument most often given for restraining government borrowing is that it tends to “crowd out” private sector borrowing, leading to an increase in interest rates. However there is ample evidence to demon- strate that a crowding out effect does not apply to most CICG borrowing.

Counterarguments to the crowding- out story go like this. Firstly, budget deficits exert downward pressure on the short-term interest rate. In such circumstances, the central bank must sell government securities in order to drain excess bank reserves, thus helping to push the short-term interest rate up to the target rate.

Secondly, CICG’s don’t compete with the private sector for funds – a CICG can access funds available from the nation’s unlimited supply of currency.

Thirdly, any funds removed by the sale of government securities (to enable the central bank to defend the target short-term interest rate) are the same funds which the CICG has injected into the economy through its own spending. In other words, the spending power injected into the economy by a CICG merely ends up as securities held by the private sector. None of this reduces the funds available for private-sector borrowing purposes.

And fourthly, banks don’t really need reserves in order to lend. Lending by banks is constrained by each bank’s net worth, not by its reserves. The explanation underpinning the money multiplier theory is a fable.

The only situation where a CICG budget deficit would be able to crowd out the private sector is when the CICG net spends to a level which pushes total spending within the economy beyond the economy’s productive capacity. This would lead to inflationary pressure, which – under our present system – requires the central bank to quell it by raising the target short-term interest rate (note that this raising of interest rates is artificial – it doesn’t occur naturally).

No advocate of MMT would recommend that CICG should net spend in this way. They argue that the net spending of a CICG should always be such that it achieves a range of economic, social, and environmental goals. Since those goals should include full employment, it also involves net spending by a CICG such that their total spending equates to the full employment level of GDP – not one dollar more, nor one dollar less.

The credit rating agencies

If neoliberal lobbyists cannot win the battle to justify an attack on deficit spending using the “crowding out” story and the fear of higher interest rates, they have a second weapon in their armoury – the widespread fear of the downgrading of government bonds by the credit rating agencies. However as has been demonstrated in various articles by Prof Bill Mitchell [4,5], the three largest credit rating agencies have not only made monu- mental mistakes over the years, but also have been paid handsomely by the companies they have been rating. This does not merely pass the smell test, but it has all the hallmarks of straight out corruption.

To date there have been no criminal prosecutions of the wrongdoers within these organisations. On the basis of their appalling track record, Mitchell recommends that the rating agencies should simply be made illegal, rather than the alternative of regulating them out of existence or legislating to make them pay cash for their mistakes.

Mitchell also refers to the experience of the Japanese government following the large-scale fiscal stimulus that it applied to its ailing economy – first announced in November 1998. The day after this announcement, the Moody’s agency began a series of downgradings of Japanese government yen-denominated bonds from AAA to eventually A2 (i.e. below that given to Botswana, Chile & Hungary).

The then Japanese finance minister stated “They’re doing it for business. Just because they do such things we won’t change our policies … and the market doesn’t seem to be paying attention”. Moreover the government continued having no problems finding buyers for their securities, which are entirely yen-denominated and sold mainly to domestic investors.

What this story demonstrates is that a sovereign government can usually afford to thumb its nose at the rating agencies, whose ratings are widely supposed to be a measure of the risk of default by a company or government on their securities. In other words, securities issued by a sover- eign government which are denominated in its own currency and issued to its domestic investors are understood and accepted by the market as having zero risk of default.

Budget deficits are the norm

For sovereign countries, the historical record reveals that deficits are the norm and surpluses are exceptional. And with very few exceptions, any surpluses that appear are short lived. In the U.S. for example, around 85% of federal budgets over the past century have been in deficit. This tendency for economies to operate in deficit mode necessarily translates into an equivalent level of sustained CICG debt.

We can be thankful that CICG’s are running budget deficits most of the time. Budget deficits keep unemployment low (they can be large enough to eliminate unemployment altogether); help CICG’s to provide the critical public goods needed and demanded (which private-sector firms require to assist them in making profits); and inject the net financial assets into the economy which the private-sector needs for its positive net saving (and necessary in order to financially stabilise economies).

The fact that 85% of U.S. federal budgets have been in deficit simply indicates that, for around 85% of the time, the U.S. private sector has wanted to positively net save out of current income. Either the U.S. federal government would have increased its spending to fill the spending gap that would have been left by the private sector (a desirable budget deficit) or it would have tried to run a budget surplus (by cutting spending and/or increasing taxes) and, since this lowers GDP, there would be reduced tax revenues.

So that at the end of the day the U.S. government would have been obliged to operate a budget deficit despite any budget objective to do otherwise (an undesirable budget deficit).

The former situation is what happen- ed in Australia when the most recent Labor government implemented its stimulus package; the latter situation is what happened in the second half of Labor’s time in office (when they thought it was time to run the budget back to surplus). And there can be no doubt that the latter result will be attempted by the current government.

Bank creation of money

The money supply can vary for all sorts of reasons. Major factors are (a) the creation of money by the banking system, in response to the demand for credit money by both the wider public and businesses, (b) the willingness of commercial banks to lend and spend, (c) the demand of the public for currency (coins and notes), and (d) the operation of fiscal policy and monetary policy.

These days, banks are permitted to create as much credit money as their net worth will allow (specifically, their capital adequacy ratio must not fall below a value prescribed by banking regulations, if they wish to remain solvent). This is one reason why monetary authorities abandoned notions of directly targeting the money supply decades ago, and instead focused on monetary policy (manipulation of short term interest rates via open market operations).

Banks differ from CICGs in that when they create a financial asset, they create a precisely matching financial liability. Hence, they do not create ‘net’ financial assets. Only a CICG can do that.

Budget surpluses are destructive

Irrespective of what is happening in the foreign sector, if a CICG attempts to run a budget surplus, it necessarily drains reserves from the banking system. The resultant competition amongst the banks for (overnight) funds pushes the short-term interest rate up. In normal circumstances, whenever interest rates rise unduly, the central bank is forced to buy CICG securities (via open market operations) in order to defend its target interest rate.

And if a CICG was disposed to use budget surpluses to impose upon the economy a sustained regime of contracting public debt, leading ultimately to zero public debt, then open market operations would become increasingly difficult to implement because there would be a growing shortage of government securities for the central bank to purchase (the stock of securities would tend to zero over time, at which stage the central bank would lose all control of monetary policy).

Although the RBA (Reserve Bank of Australia) has never encountered the problem of having no Treasury securities whatsoever to purchase, their shortage during the Howard/ Costello years of government – which was brought about by several years of budget surpluses – produced much angst amongst many private-sector institutions and corporations. And in response, the federal government financially guaranteed many private- sector financial assets as a way to counter the effects of the Treasury bond shortage.

The real dire effect of a CICG budget surplus is that it forces the private sector to reduce its net savings and/or to replace some of its assets with riskier assets, and to borrow in many instances, in order to maintain its spending desires (Australia from 1996 to 2007). This is a financially unsustainable regime. It eventually forces the private sector to abandon many of its spending desires and to focus on its net savings (paying back its debts). If this happens, private- sector spending quickly collapses.

CICG surpluses are a sure way to set an economy up for financial collapse. It is notable that Australia’s last major recession in 1990-91 followed a budget surplus in 1989.

CICG’s don’t hoard surpluses, even if they behave as if they do. How can you hoard something that you have an infinite supply of? Any amount of the nation’s currency can be spent into existence by a CICG at any time. Surpluses do nothing other than to reduce spending on the public goods and infrastructure needed to ensure that future generations will be productive enough to meet their demand for goods and services. And attempting to ensure that future CICGs will have enough money to spend in the future is absurd – they will have it anyway.

Australia and the global financial crisis

Federal governments should be aware that budget surpluses create private-sector deficits, which are financially unsustainable. The notion of a ‘sustainable budget surplus’, which has been circulated by the current federal government and the media, is nonsense. The only budget position that is sustainable over the long run is a deficit. That said, budget surpluses can look good for a while. If achieved, they can enable misguided Treasurers to beat their chest (e.g. Peter Costello). Since, to achieve a budget surplus, the private sector must maintain its spending desires (but abandon its savings desires), Thus GDP will remain buoyant and unemployment relatively low for a while. However this always sets up the economy for a crash.

Peter Costello can still boast of his budgetary ‘success’ because the GFC occurred just after the Coalition government lost office in 2007. Very few people blamed Peter Costello because he had vacated the scene. He was also fortunate in that the 1996-2007 period was one where Australians were willing to take on huge debts in order to maintain their spending.

A booming property market enabled the perceived level of serviceable debts to be larger than was the reality, and so Australians borrowed beyond what they could service. The same occurred in the U.S. and many parts of Europe. This meant that the economy fell off a higher cliff – a cliff which the global economy almost fell off in 2001 (it would have been a lower cliff at that point in time).

Australia did not feel the worst of the global financial crisis (GFC) because the government in 2008/9 decided to implement one of the most vigorous stimulus packages in the world. The Labor government at that time have been unjustly blamed by many for a mess that was actually created by the previous Coalition government.

In regard to how the rest of the world responded to the GFC, the U.S. federal government did not institute a similar fiscal stimulus, while the E.U. governments were incapable of any fiscal stimulus because each of them had given up monopoly ownership and issuance of their currency and so were budget constrained.

The structure of the Eurozone also has a lot to do with the difficulties experienced by E.U. countries since the onset of the GFC. The European Central Bank (ECB) is incapable of acting in the way that the central banks of all sovereign countries operate. Eurozone countries have been pushed into the bond crisis because financial markets fear a lack of liquidity. And this fear cannot be allayed because the ECB is simply not permitted to act as a lender of last resort and to create new credit money in order to purchase bonds. This in turn has seen higher bond yields on the debt of Eurozone countries, And as a result of this bond crisis, the constituent governments have been persuaded to impose spending cuts and budget austerity.

Concluding comments

The major differences between the orthodox (neoclassical) and heterodox (mainly post-Keyensian and MMT) viewpoints as they pertain to the role of debt in the economy are as follows.

Fig 3. Comparison of net government debt (to GDP) for a range of countries.

Orthodox viewpoint:

- Economies tend towards a stable equilibrium configuration.

- Private borrowing, spending and saving decisions are always driven by “rational expectations”.

- Banking and money flows don’t affect economic performance.

- Private debt growth does not affect economic performance.

- Public debt (deficit spending) must be minimised since it leads to rising inflation and rising interest rates.

Heterodox viewpoint:

- Economies generally operate far from equilibrium.

- The idea of rational expectations is a fiction unsupported by evidence.

- Banking and the creation of new money by banks matter because they contribute to purchasing power and economic performance.

- Private debt growth (in relation to GDP) must be restrained because if excessive it will set the economy up for a crash.

- The volume of CICG debt (aka Treasury securities) should rise to whatever level is required for the operation of a healthy economy.

References:

John Hermann wishes to acknowledge the advice and guidance of Assoc. Prof Philip Lawn in the preparation of this article.