The economic theory that is wrecking Europe – Steve Keen

The following is an extract from Prof Steve Keen’s recent article on the economic foundations of the European economic malaise.

Translations of my book Debunking Economics have helped spread the understanding that the parlous state of the European economy is a direct consequence of the bad, mainstream economic theory followed by Brussels and imposed on the national governments that are imprisoned inside the Maastricht Treaty.

The guiding principle of the Maastricht Treaty and the “Stability and Growth Pact” was that economic growth and stability are enhanced by adhering to a balanced budget over the long term.

For this reason they imposed two key rules: that government debt should not exceed 60 per cent of GDP, and that the government deficit in any one year should not exceed 3 per cent of GDP.

If you read those documents without knowing the economic theory that lies behind them, they can seem both solemn and logical. The statements about ensuring “that fiscal policy is conducted in a sustainable manner over the cycle,” that “excessive deficits” are avoided, and the “imposition of sanctions” should the Pact’s “rule- based framework” be breached, make the Pact appear to be based on principles as sound and unavoidable as the Law of Gravity. One might complain about the Law of Gravity in some circumstances – like when you have fallen out of a window – but there is nothing you can do but obey it.

However, if you read the economic theory from which these apparently profound pronouncements are derived, it is obvious that the Stability and Growth Pact is based on a set of economic delusions that result in mayhem when they are applied in the real world.

The mad economic idea at the core of the Stability and Growth Pact was devised by the American economist Robert Barro and dubbed “Ricardian Equivalence” (Barro 1989). The starting point of this idea was the superficially reasonable argument that a government’s spending is constrained by its income: just as a household’s spending is limited by its income, a government’s spending is limited by its taxation revenue. Therefore, Barro asserted, governments must run a balanced budget over the long term, and a deficit-financed cut in taxes now, must lead to an increase in taxes in the future.

This argument alone wasn’t enough to base a Treaty on, because many other economists argued that the government should run a deficit during an economic downturn, since this would stimulate the economy and make the downturn less severe. It was this “Keynesian” argument that Barro wanted to destroy.

To do so, Barro added the argument that the public knows that lower taxes now require higher taxes in future, so that the public will reduce its spending when the government runs a deficit, to save today to pay the higher taxes that will fall due in the future. Hence increased government spending via a deficit is counteracted by less spending by the public.

One obvious rejoinder to Barro’s argument was that a government deficit occurs now, while the future taxes it will cause may be imposed in the very distant future – maybe even after many of today’s taxpayers have died. Why should someone save to pay taxes that might not even be levied on them?

Their spending should remain much the same when the government runs a deficit, so that the deficit will stimulate the economy.

This is where Barro’s argument took a leap from the superficially reasonable to the obviously delusional. He argued that people alive today reduce their consumption when the government runs a deficit so that they can leave behind a bequest to enable far distant descendants to pay the eventual tax: “a network of intergenerational transfers makes the typical person a part of an extended family that goes on indefinitely. In this setting, households capitalize the entire array of expected future taxes, and thereby plan effectively with an infinite horizon.” (Barro 1989, p. 40)

Do you see that insane assumption in the Stability and Growth Pact? Of course not — no politician, I hope, would have signed that Pact if they knew that it relied upon mad ideas like this.

But this is routinely the case in mainstream economic theory. Exposing these critical flaws in mainstream economics is the main purpose of my book Debunking Economics.

The economic crisis in France shows that this is not merely an academic exercise. Since these flawed ideas in economics have been accepted by Brussels, they rule economic policy in Europe. And these flawed ideas have both caused immense economic suffering, and distracted attention from the real causes of Europe’s crisis.

With a different, realistic approach to economic theory, the “solemn and logical” ideas in the Stability and Growth Pact are in fact farcical and stupid. Consider the argument that the government should run a balanced budget over the long term for example, which is based on seeing an analogy between households and the government. Is this the correct analogy?

What if, instead, a government was more “like a bank” than “like a house- hold”? Would we insist that banks should follow “a balanced budget rule”? That would mean that, over the long term, bank lending should be exactly matched by retail loan repayments.

A moment’s thought – and knowledge of how money is created – would reveal this to be a silly idea. If loans exactly matched repayments, the money supply would not grow. But a growing economy needs a growing money supply: there has never been an economy in the world that has grown for long in real terms when its money supply was shrinking. So clearly, in a growing economy, loans should exceed deposits over time. In that sense, banks should “run a deficit”: their “money out” in terms of new loans should be greater than their “money back in” in the form of loan repayments.

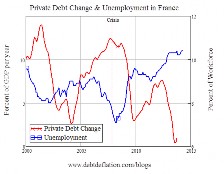

The same observation applies to the government, which can also create money by running a deficit. If the economy is growing, then the economy needs some of that money to be created by the government – otherwise we rely solely upon the banks. And a moment’s reflection on the crisis itself – and the last 40 years of economic instability – shows that relying on the banks is not a good idea. The banks created too much private debt-based money, causing housing bubbles that generated much apparent prosperity as they grew, but economic crisis when they collapsed.

We need a growing money supply, but we need that growth to finance proper investment rather than speculation. If part of the money supply growth comes from a government deficit, rather than from bank lending, there could be less damaging speculation and more productive investment.

The “Growth and Stability Pact” made this impossible by imposing a zero deficit rule on governments. Far from leading to “Growth and Stability”, the pact resulted in economic instability— as the banks lent wildly—followed by economic collapse. The pact then turned the downturn into a Depression by trying to directly reduce public debt, while ignoring the private debt that caused the crisis in the first place.

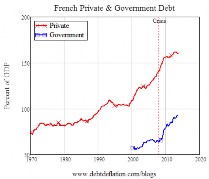

The European Commission makes much of the fact that public debt in France has risen from 63 per cent of GDP when the crisis began – 3 per cent over the Maastricht limit — to 93 per cent. But when the crisis began, private debt in France was 140 per cent of GDP — more than twice government debt. It is now 160 per cent. Why do the bureaucrats in Brussels not worry about this level of debt?

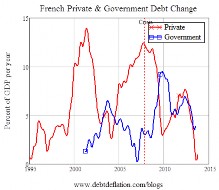

It’s because bad mainstream economic theory tells them that they don’t need to worry about private debt. Their theories are wrong, but they are being imposed on reality thanks to the blind belief in mainstream economics in Brussels. The naïve view of money and the role of government that is embedded in the “Growth and Stability Pact” means that the decline in the growth of government debt has compounded the problem of declining private money creation as well. This is the opposite of what happened before Brussels imposed its sanctions (see Figure 2).[su_spacer size=”10″]

The poor and unemployed of Europe are now paying for the mistakes of economic theory, which it why it is so important that mainstream economic theory be exposed for being the impostor that it is.

[su_spacer size=”10″]

[su_spacer size=”10″]

Source: Business Spectator, 6 Sep 2014 http://www.businessspectator.com.au/article/20 14/10/6/european-crisis/economic-theory-wrecking-europe?utm_source=exact&utm_ medium=email&utm_content=940887&utm_campaign=kgb&modapt=

![]()

Dr Steve Keen is a Professor of Economics and Head of the School of Politics, History and Economics at Kingston University in London.