It’s a wonderful life?

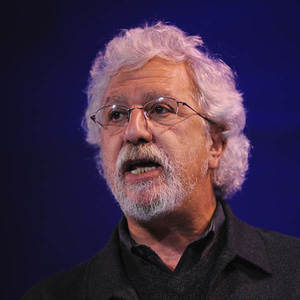

David Ruccio

Harvard economics professor Sendhil Mullainathan is worried that too many of his students are taking jobs in finance. He should be worried for other reasons, too. Mullainathan’s concern stems from the idea that much of the activity in the financial sector involves “rent-seeking”:

“ Instead of creating wealth, rent seekers simply transfer it – from others to themselves. . .

“ The economists Eric Budish at the Booth School of Business and Peter Cramton at the University of Maryland, and John J. Shim, a Ph.D. candidate at Booth, have shown in a study how extreme this financial gold rush has become in at least one corner of the financial world. From 2005 to 2011, they found that the duration of arbitrage opportunities in the Chicago Mercantile Exchange and the New York Stock Exchange declined from a median of 97 milliseconds to seven milliseconds. No doubt that’s an achievement, but correcting mispricing at this speed is unlikely to have any real social benefit: What serious investment is being guided by prices at the millisecond level? Short-term arbitrage, while lucrative, seems to be mainly rent- seeking.

“ This kind of rent-seeking behavior is widespread in other parts of finance. Banks sometimes make money by using hidden fees rather than adding true value. Debt collection agencies may use unscrupulous practices.

Lenders to poor people buying used cars can make profits with business models that encourage high rates of default — making money by taking advantage of people’s overconfidence about what cars they can afford and by repossessing vehicles. These kinds of practices may be both lucrative — and socially pernicious. “

Mullainathan makes clear that that kind of rent-seeking behavior is ubiquitous in the world of finance. But, it seems to me, he has an even bigger problem: it’s not clear there’s an area in finance that doesn’t involve some kind of rent-seek- ing (or, as I prefer, surplus-seeking) behavior. The best Mullainathan can come up with is a general summary of the effects of the division of labor in Adam Smith and a movie, It’s a Wonderful Life.

Mainstream economists and Wall Street bankers have tried mightily to come up with concepts and measures of how the financial sector creates value and thus has an economic or social benefit. But, in the end (to judge by Mullainathan’s column), they’ve failed.

Finance may be very lucrative, for banking institutions and Harvard students alike, but all it does is capture some of the value created elsewhere in the economy. And in an attempt to capture more and more of that value, by taking advantage of arbitrage opportunities and developing new financial instruments, it created the worst crisis since the first Great Depression.

Not even George Bailey would have been able to prevent that from happening.

Source: Real World Econ Rev, 12 Apr 2015 https://rwer.wordpress.com/2015/04/12/its-a-wonderful-life/

Prof David Ruccio, PhD, is an economist at the University of Notre Dame, Indiana USA, where he has been teaching since 1982.