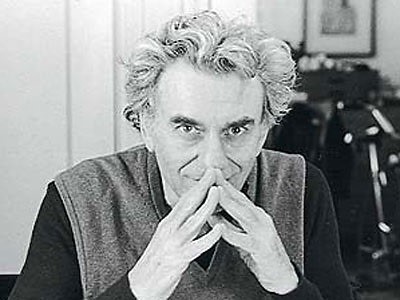

Hyman Minsky, and the financial instability hypothesis

Steven Hail

A simple explanation of why our economy goes up, up, up, then down, down, down!

Hyman Minsky wrote three great, even if hard to read, books – including, in 1982, ‘Can “It” Happen Again?’ (meaning the 1929 Crash); and also in 1996 ‘Stabilising an Unstable Economy’.

What is now known as Modern money theory (MMT) was developed by students and colleagues of Minsky after his death, and in some ways it is an extension of his ideas. According to Minsky, capitalism can only ever deliver full employment fleetingly, and only at the cost of inflation and/or a financial crisis.

Minsky is famous now for his ‘financial instability hypothesis’ although it was almost totally ignored from the early 1980s up to 2007.

The Global financial crisis (GFC) was labelled a ‘Minsky Moment’ by investment banker Paul McCulley. When Queen Elizabeth II and others asked ‘why did nobody see this coming?’, the answer they never got back from mainstream economists was that Minsky saw it coming many years before. Moreover, some of Minsky’s students (including Randall Wray and Australia’s Bill Mitchell) also had been issuing warnings and had been ignored for years.

Minsky pointed out the following things:

1) That financial crises are normal in modern capitalism there was a financial crisis in the USA roughly once in every decade from 1800 until 1929, while following a tranquil period from 1945 to the mid-60s, small incipient crises returned in 1966, 1970, 1974,

1981, 1987 and 1992.

After his death came the Asian Financial Crisis and the technology stock crash of 2000 then the GFC in 2008.

2) That, although Keynes in the 1930s mainly wrote about Depression, there was also in his theory of economies the implication that the main instability in capitalism was upwards -a tenden-cy towards euphoria and boom, follow-ed by crash. Minsky said that ‘stability breeds instability’. Others have said ‘success breeds success breeds failure’. Minsky’s theory also fits well with modern psychology, which is almost completely ignored by mainstream economics, and even with what we have learned (much of it in the last 10 years) about how our brains work.

Minsky classified private sector balance sheets as one of: ‘hedge’ (which means super-safe, and bankruptcy in the near future is out of the question); ‘speculative’ (which means that one expects income to service one’s debts, but they cannot be paid off, so they must be rolled over when they mature; all banks are speculative, in this sense); or ‘Ponzi’ (which means the only way one can pay off one’s debts is if and when it is possible to enjoy capital gains on shares, property or other investment assets).

During good times, those with more risky balance sheets will be the most profitable, and those with hedge balance sheets will fall behind. In a rising market, taking a risk pays off. So gradually those with hedge balance sheets move to speculative ones and those with speculative balance sheets move to Ponzi ones.

Meanwhile, the banks they usually borrow from have few to no bad debts, and become more convinced that the loans they are making are safe, and consequently take more and more risks with their lending. Borrowing of money becomes easier and easier.

Meanwhile, the regulators come to believe the system is well managed, and take their eyes off the ball.

Then economists (who as neoclassicals are strangely attracted to the idea that the economy is a magical selfregulator, with an equilibrium, and needs no regulation or supervision) argue for deregulation.

Lastly, conservative politicians lustily agree with this, and progressive politicians go along with it (who are they to argue with the ‘experts’?).

So a safe system inevitably becomes a more dangerous one, as the very regulations that made it safe are relaxed, and the balance sheets which were so safe become far less so.

Then a crisis occurs. The trigger? Maybe rising oil prices pushing inflation up resulting in higher interest rates (given that a central bank is targeting inflation). It could be anything really. Speculative asset prices (generally shares or property or both) freeze, and go backwards. Those with Ponzi balance sheets are in trouble and panic. An incipient crisis has begun.

Starting from high interest rates and a government that feels it can deficit spend, Minsky argues that a small crisis can be averted by what he called the ‘Big Bank’ (ie. the Federal Reserve or the RBA) and the Big Government interest rate cuts and big increases in government spending, putting a floor under the crisis. Other measures, like a first home buyers grant can specifically support asset prices. The crisis is attenuated. An upswing can be re-established.

The problem is, Minsky said, that a moral hazard has been set up. There is moral hazard when circumstances create incentives for excessive risk taking. The rescue from a small crisis creates an impression there will never be a big crisis, and validates the behaviour of the private sector. This leads inevitably to another crisis probably a more significant one.

You can only cut interest rates so far until you reach zero. MMT has shown that there is no technical limit to government spending, but most people don’t know this, and governments certainly feel there is a political limit.

That is when ‘IT’ (1929, or a bit worse than 2008) can happen again. The ‘Minsky Moment’. A crisis that policy makers feel they can do nothing about.

That is the time to reform economics, policy and institutions. But beware! Neoclassical economists have been so brainwashed by the idea of equilibrium, that as soon a stability is regained they will start arguing once again (as Friedman and others did soon after the Depression) that the reforms should be undone once more. And profit maximising bankers and business people will heartily agree that government is bad, regulation is bad, and ‘red tape’ should be cut. It has always been this way.

Looked at this way, the period from 1945-75 (or so) is an exceptional period in economic history. No significant financial crises like no period before or since. Full employment like no period before or since. Economic growth and poverty alleviation like no period before or since. Narrowing income distribution, like no period before or since. No significant inflation prior to the 1973 OPEC event.

How to explain this?

(a) Super secure private sector balance sheets, after the War, loaded up with tons of safe government debt. Banks held as much as 35-40% (or more) of their assets in government securities. For a long time they did not need to engage in risky financing prac-tices and dodgy innovations to raise funding. Government indebtedness was massively higher than it is now, and this was a GOOD thing.

(b) Super conservative attitudes to borrowing and to speculation, following the massive disaster of 1929-33.

(c) Super-tight banking regulations in the US and elsewhere, after the excesses of the 1920s. The US GlassSteagall Act was in place until 1999. Bill Clinton signed away this vital piece of protection and helped create the conditions for mortgage securitisation and the GFC.

(d) Rising real wages, made possible by productivity gains, meaning people could spend more without needing to borrow more. This ended in the US in about 1970. Ordinary people in the US have had no hourly pay rises since then. They have had to go into debt and/or work longer hours, to support their addiction to consumption, ever since.

What to do?

1. Re-regulate finance. But accept that it is a slippery beast, that today’s regulations will be evaded tomorrow, and that therefore the process of reregulation must be on-going. Competition leads to excess risk in finance. This is one sector of the economy where a sleepy, conservative (even inefficient) industry would be a good thing. The option of a state owned commercial and/or investment bank should not be rejected out of hand.

2. Introduce a job guarantee scheme.

3. . Remove incentives for speculation tax breaks on super, on shares and on property.

4. Run a responsible government deficit (larger than now, and probably much larger) to allow for the private sector to repair and restore its super-safe balance sheets.

5. Explain why you are doing this.

Useful References:

1. https://www.socialscience.international/hyman-minsky-financial-instabilityhypothesis

2. https://www.tutor2u.net/economics/blog/hyman-minsky-the-financial-instabilityhypothesis

3. https://en.wikipdia.org/wiki/Hyman_Minsky

Dr Steven Hail is an Associate Professor at Torrens University, and is one of Australia’s leading modern monetary theory economists.

Dr Steven Hail is an Associate Professor at Torrens University, and is one of Australia’s leading modern monetary theory economists.