Complex economies embedded in the biosphere with the commons restored – Part 1

Geoff Davies

How can we construct an economics consistent with the biophysical limits to economic growth? First, we can consider the kind of economies and economics that can support human societies healthily into the indefinite future. Then we may consider what drives unlimited growth in the present regime and how pathological growth may be not only limited but excluded from healthy economies.

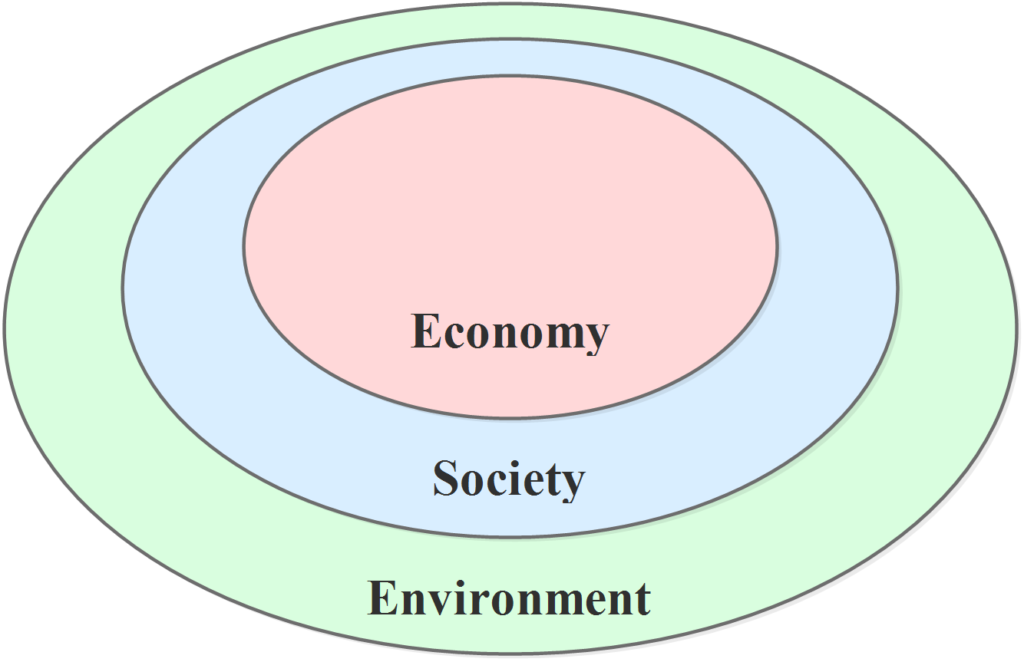

A science of human economies must start from the knowledge that human beings are part of the natural living world, the biosphere of planet Earth. We and our societies are intimately embedded within the biosphere. An economy in turn is embedded within a society: it is the way a society collectively provides for its material needs.

Living systems are complex self-organising systems [1]. An economy is necessarily also a complex self-organising system because many of its components are living (people, food plants, food animals, and so on). An economy would be complex anyway because of the large flow of energy through it as well as its many nonlinear interactions. A modern economy is a far-from-equilibrium system.

Thus to adequately study an economy we must understand complexity. The behaviour of any complex system is fundamentally determined by the nature of its internal interactions. Within a modern economy there are two main kinds of interaction: social and exchange, the latter being largely mediated by money. Thus we must understand money and social interactions.

The social behaviour of human beings may be said to be neither wholly competitive nor wholly cooperative, but a subtle balancing of the two modes, from which the richness of human experience arises. This co-existence of cooperation and competition occurs pervasively in the living world.

Understanding money requires clarity on the nature of modern token money and on the roles of central banks and commercial banks. Token money involves debt, which links the future to the present, as Keynes observed (quoted by Keen [2], p. 293-4). It thus exerts a powerful influence on the dynamics of an economy, that is, the way in which the economy unfolds into the future. Because the future is unknowable, debt also introduces risk. Token money is powerful but dangerous. And like fire, it must be handled with great care.

The primary purpose of an economy is to support the society of which it is a part. This support must encompass not only the welfare of the society’s members, but also the continuation of the society in a form that its members desire. In addition it must encompass the continuing health of the biosphere within which the society is embedded.

Managing an economy requires proper balance-sheet accounting, not just a crude tally like Gross Domestic Product. The accounting must encompass the material provisioning of the society, the health of the society, and the state of the biosphere. Triple-bottomline accounting covering the economy, society and the environment attempts to do this, and it can be extended and refined.

A key requirement of economic management is to ensure a fair flow of wealth to all members of society. All wealth is generated collectively. Any enterprise draws upon our inherited culture, and the vast accumulation of knowledge that is part of that inheritance. Any enterprise also requires an ordered society and many functioning institutions in order to conduct its business. Thus no-one has an exclusive claim on any new wealth generation, and everyone has some claim, by virtue of their common inheritance.

Wealth distribution is best managed at the source, through appropriate forms of collective ownership, such as cooperatives involving employees, managers and possibly other stakeholders. In this way wealth can flow automatically to all those directly involved, and the flows can be adjusted to ensure fair shares for all parties. Some collective forms, such as sociocracy [3], go further and effectively distribute management to all of the parties in an enterprise.

The dominant current form of collective ownership, corporations, is pathological, in that wealth can be managed to flow predominantly to managers and shareholders, at the expense of employees. Competitive markets also induce pathology by encouraging the corporations to be exploitative and extractive: rather than generating new wealth, it is often easier to extract the existing wealth from people, societies and the environment, thus further unbalancing the flow of wealth.

If appropriate forms of ownership are not sufficient to ensure fair flows of wealth then retroactive actions, such as progressive income taxes, government services, welfare payments or a universal basic income, could also be implemented or continued. However retroactive actions are more cumbersome, less efficient and more likely to be resented, making them more prone to abuse.

Land, in the sense of an area of the Earth’s surface, requires special consideration. There are two key aspects. One is that land is part of our common inheritance: it is just there, and no-one makes it. Consequently there is no cost of production that might anchor the price of land. In a sense the ‘price’ is arbitrary, and this makes it especially prone to speculation. It would far better reflect its nature if land was leased [4]. It could be managed, for example, by community land trusts, in effect acting on behalf of our collective inheritance.

The other important aspect of land is that part of its value arises from what is adjacent to it. A hectare of vacant land in a city is worth more, in terms of its potential benefit to an owner, than a hectare in a sparsely populated desert. This value should not belong to the owner, because it arises from the actions of the community around the land. Because this value emerges as the community develops, I have called it the emergent community value of the land, and it was a central but much repressed insight of Henry George [5]. This component of wealth ought therefore to flow back to the general community, which could be accomplished also through a community land trust.

Analogous considerations also apply to natural resources. Non-living or mineral resources are a part of our common inheritance, and wealth derived from them ought to flow widely to the society in whose territory they occur or perhaps even to all of humanity. Non-renewable resources of course ought to be managed frugally, whereas at present they are extracted profligately. Living, renewable resources are part of the biosphere and their health and continuance ought to be an automatic part of the management of an economy, as already described.

The kind of economy briefly outlined here is developed more fully in Economy, Society, Nature [6]. It is radically different from the presently dominant regime, but it needs to be because the present system is so pathological that it threatens to destroy our modern civilisation, along with much of the human and non-human population of the planet. Unrestrained growth of the GDP is one source of its pathology.

A healthy economy will also involve many more details than are mentioned here, but this outline can indicate both its broad character and how it might be managed.

To address the pathological growth of modern industrial economies we must first of all carefully define what we mean, and what we want. Not all kinds of ‘growth’ are undesirable. We need then to identify the underlying driver of undesirable growth before we can attempt to change or stop it.

Much of the current debate about economic growth, de-growth or steady state fails to specify what it is that is growing [7]. Usually it is the Gross Domestic Product that is implied to be growing, or not. But GDP is not directly the culprit. The culprit is the ever-rising throughput of materials the extraction, manufacture, use and dumping of ever-more stuff. It is that material throughput that causes resource depletion and the planet-wide harmful pollution that is degrading our living planet, our life support system.

– – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – – –

The oldest problem in economic education is how to exclude the incompetent. A certain glib mastery of verbiage – the ability to speak portentously and sententiously about the relation of money supply to the price level – is easy for the unlearned and may even be aided by a mildly enfeebled intellect. The requirement that there be ability to master difficult models, including ones for which mathematical competence is required, is a highly useful screening device.

― J. K. Galbraith, Economics, Peace and Laughter