Which GDP?

Greg Reid

In great fanfare the G20 has pledged to raise GDP by 2.1%, but some parts of GDP increase employment while other parts contribute to wealth inequality, so which GDP should we try to grow?

GDP is a crude measure poorly suited to comparing countries and even less appropriate as a guide to management. Unfortunately GDP is so embedded in national accounts that it will not be easily overthrown by any new measure. As a first step however, GDP might be divided into categories that provide more information. Total GDP might expand but changes in the proportions of different categories will draw attention to the type of economy and society we are building.

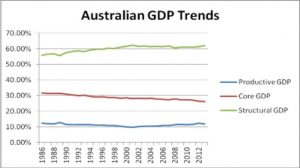

Using the “Industry Gross Value Added” statistics for GDP it is possible to divide GDP into three categories. “Productive GDP” which increases the future supply, efficiency or quality of goods and services and includes items such as engineering construction, research, education, recycling, mining exploration, and machinery. “Productive GDP” actually declined slightly in Australia from 12.4% in 1986 to 11.8% in 2013.

“Core GDP” meets the direct needs of the population and includes housing, health, food, utilities, transport, roads and manufactured goods. This type of GDP declined substantially from 31.7% to 26.3% primarily due to a collapse in domestic manufacturing and reduced investment in new dwellings.

Growth in Australian GDP was almost entirely concentrated in “Structural GDP” which is necessary but does not directly contribute to the added availability of core needs. “Structural GDP” increased from 55.9% to 62% and includes wholesale, retail, mining, financial services, defence, administration etc.

The “value added” approach has a number of limitations but nevertheless indicates growth concentrated in areas that contribute more to wealth inequality than to the supply of core needs. For example, mining represents only 2% of the workforce, and per employee pays nearly four times the average wage and needs twenty times the average capital investment. Growth concentrated in mining will only provide limited benefit to the general population at high cost.

The “value added” approach has a number of limitations but nevertheless indicates growth concentrated in areas that contribute more to wealth inequality than to the supply of core needs. For example, mining represents only 2% of the workforce, and per employee pays nearly four times the average wage and needs twenty times the average capital investment. Growth concentrated in mining will only provide limited benefit to the general population at high cost.

Other “Structural GDP” sectors exhibit opposite qualities that magnify the problem. Hospitality covers 8.7% of the workforce, requires only one fifth of average capital investment per employee and has grown twice as much as the mining industry in the last six years. Hospitality wages however have barely moved and are less than half the national average so growth in this sector increases inequality.

Much employment in the “Structural GDP” sector also lacks a stable home advantage. Information Technology and Telecommunications is a sector with wages 28% above average which have grown 16% in six years but employment has actually fallen as services have been outsourced overseas. Many jobs in administration and professional services may go the same way as skill standards rise in Asian countries.

The reality is that general growth in GDP will only guarantee prosperity for some Australians and does not build a sustainable economy. Favouring growth in the “Productive” and “Core” sectors would tend to lower living costs, provide more employment with reasonable wages and would steer development toward sustainable sectors which are less vulnerable to resource depletion or job outsourcing.

Greg Reid is an ERA member living in NSW