Manhattan project to prevent hyperinflation

J.D. Alt

The previous issue of ERA Review contains an article entitled The causes of hyperinflation in Zimbabwe in which it is stated that in practice hyperinflation is almost always caused by a supply failure, rather than by the creation of new money. There have been many expressions of concern that current government spending programs designed to provide life support and retain jobs in the wake of the viral pandemic will generate hyperinflation of the Weimar or Zimbabwe type. Former US Treasury Secretary Larry Summers has been particularly vocal on this issue. We therefore feel that the following article by J.D. Alt, although written about one year ago, remains topical and relevant. (Ed)

It’s ironic that, at this moment, when the truthfulness and utility of modern money theory (MMT) is being publicly realized – and implemented – that its singular vulnerability emerges as a real concern: hyperinflation.

A recent book that I’ve written – Paying Ourselves to Save the Planet addresses the issue of hyperinflation as follows:

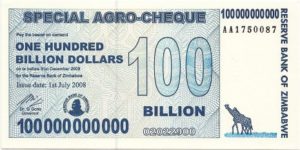

“Hyperinflation” is a rate of inflation that happens so rapidly there’s no opportunity for people and businesses to adjust. Prices are, suddenly, noticeably higher -and then still higher tomorrow – and higher yet the day after. The money in my bank account suddenly can’t buy half of what it could last week. In a rush to keep the economy from collapsing, the currency-issuing government issues more and more money to in order to enable consumers to continue buying – and ultimately must begin adding more and more zeroes to its paper dollars. This leads to economic and social chaos at every level.

“It appears that hyperinflation is caused by the government issuing too much money – and it is for this reason that MMT is often attacked, by standard theory advocates, as a precursor to economic disaster. The issuing of too much hyperinflationary money, how- ever, is a reflexive, emergency government response to another underlying problem that caused the hyperinflation to get started in the first place. To say that “printing money” causes hyperinflation is like saying “flames” cause a fire.

“The underlying problem that has caused every historical (and contemporary) instance of hyperinflation is the same: the significant and general collapse of a nation’s production of goods and services. This happened in post-WW1 Germany when the Weimar Republic shut down its manufacturing heartland as a refusal to acquiesce to unfair war reparations imposed by the Allies. It happened in Zimbabwe when Robert Mugabe evicted white landowners from their farms – which were the agricultural-financial foundation of the economy – and gave the land to new black owners without preparing them to operate the farms.

“The ensuing collapse of the Zimbabwean agricultural economy quickly led to one of the most infamous hyperinfltion periods recorded. The same type of general collapse of production is happening in Venezuela today, with the hyperinflation being fuelled further by a collapse in national income from that country’s oil exports – which had been used for importing most of the goods on Venezuelan store-shelves. The result being empty shelves, but lots of bolivars in people’s pockets. “

The book goes on to observe that none of the actions contemplated to “save the planet” from the climate-crisis would have the effect of causing “a significant and general collapse of a nation’s production of goods and services”. Quite the opposite, in fact, would be expected: The not-profit-making, public enterprise efforts would employ millions of people to produce a broad spectrum of goods and services — and that new employment, in turn, would support a broad spectrum of profit-making, private enterprise ventures. All along the lines that MMT has been arguing for years.

This is not, however, what is happening now with the fight against the Covid-19 virus – and the desperate efforts by many governments to put money in the pockets of people who can’t work and businesses who can’t open their doors to customers. So, while we’re discovering first hand and in real-time that, yes, sovereign currency issuing governments can, in fact, just create money so they can spend it – without having to collect it back in taxes, either now or in the future – we are also laying potential groundwork for causing the hyperinflations described above: “A significant and general collapse” of our business and employment framework is happening before our eyes, while our government feverishly dishes out money.

Not that the money shouldn’t be dished out. But it must be accompanied by an intelligent, broad and aggressive effort to shorten the “collapse” and to restart production and consumption of goods and services – and also the public must be aware that this effort is being under- taken. Nothing short of a full-blown and well-publicised mobilization for a “Manhattan Project” to defeat the virus will get the job done.

This must include, as a start, 100% testing and a centrally coordinated, federally mandated, production and manufacturing ramp-up of medical supplies (including vaccines), equipment, emergency facilities, and well publicised advice from authorities on modes of behaviour designed to minimize the risk of becoming infected.

MMT, from my perspective, has never been about giving people money – it’s about paying people to produce not- profit-making goods and services which benefit collective society. It would be a tragedy if the sovereign spending efforts being envisioned and enacted now accomplished only the first, and left the second undone – setting the stage for a hyperinflation that might ruin the promise of modern money theory for a generation to come.

Source:

New Economic Perspectives, 26 Mar 2020 http://neweconomicperspectives.org/2020/03/manhattan-project-to-prevent-hyper-inflation.html