The Howard Roarke of Economics

David Lawson

(Ref: http://www.debtdeflation.com/blogs/)

Men have been taught that it is virtue to agree with others. But the creator is the man who disagrees. Men have been taught that it is virtue to swim with the current. But the creator is the man who goes against the current. Men have been taught that it is virtue to stand together. But the creator stands alone. [1]

For those who are unfamiliar with this quote, it is taken from The Fountainhead, by Ayn Rand, and I recommend it as a highly amusing fictional read. I do find it rather ironic that this quote is easily applicable to Professor Steve Keen’s constructively creative approach to economic theory. Sadly, neoclassical economics— today’s conventional economic current–is the second hander of this defunct “free market” economic postulate that Ayn Rand helped cultivate through her far right-wing philosophy of Objectivism. If neoclassical economics is a religion, then Objectivism is more of a cult! Even more amusing than her fictional novels themselves, was that Ayn Rand refused to drink her own Kool-Aid when she used the very welfare system that she spent her life campaigning against.

However, the ignorance of her second hand followers is more disturbing than amusing. Her so called masterpiece Atlas Shugged has been called the second most influential book to the bible in the United States. Alan Greenspan, winner of the Dynamite Prize, acknowledged it, saying that “Atlas Shrugged is a celebration of life and happiness”. Other second handers of Rand’s unsound philosophy, Donald Luskin & Andrew Greta, who wrote the book I am John Galt, claimed in it that “Milton Friedman… made economics into a science…”

Readers of Steve’s Debunking Economics should be aware how absurd it is to characterise economics as a science – let alone the Neoclassical vein that Friedman promoted with claims like:

“The societies that have achieved the most spectacular, broad-based economic progress in the shortest period of time, are not the most tightly controlled, not necessarily the biggest in size or the wealthiest in natural resources. No, what unites them all is their willingness to believe in the magic of the marketplace. [2]

Magic? Friedman’s claims aren’t scientific, they are a paean to an illusion! Meanwhile, Milton Friedman, was Reagan’s economic adviser and once described by Joan Robinson as “… a man who would put a rabbit into a hat, in full view in front of an audience and expect applause as a magician when he pulled it out shortly after wards” . Even his magic was second hand.

Friedman, who played a primary role in vanquishing money, banks and debt from economic theory, is also well known for his quote:

… inflation is always and everywhere a monetary phenomenon … [3]

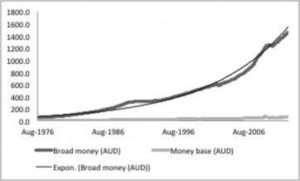

However, in the excessively leveraged and euphorically prosperous economy built on Friedman’s delusions, broad money exponentially deviates from base money, making moral hazard always and everywhere an economic phenomenon!

Source: [4] As the renowned American physicist Prof Albert Allen Bartlett said once:

Source: [4] As the renowned American physicist Prof Albert Allen Bartlett said once:

‘The great est shortcoming of the hum an race is our in ability to understand the exponential function. ’

However, I do not believe this statement to be fully correct. I am sure that today’s banking authorities like Ben Bernanke and Glenn Stevens understand the exponential function quite well. What they ignore are its implications for their second hand Neoclassical theories. Their Peter Keating approach to solving the Global Financial Crisis clearly lacks any sustainable creativity. Unfortunately, the greatest shortcoming of the human race is simply human ignorance, and Ayn Rand was testament to this fact.

References

[1] ‘The Fountainhead’, Ayn Rand, p. 713, Penguin Books, 2007, England.

[2] ‘The Counter-Revolution in Monetary Theory’ (Occasional Paper 33), Milton Friedman, p. 24, The Institute of Economic Affairs: The Wincott Foundation, 1970, Great Britain, Tonbridge Printers Ltd.

[3] Ronald Reagan, former President of the United States, in the film: Enron: The Smartest Guy In The Room by Alex Gibney (director), 2005.

[4] Based on Reserve Bank of Australia, ‘Statistics, Financial Aggregates, Monetary Aggregates – D3 [XLS]’ – electronic delivery. Release date: 30 April 2012. Available at:

http://www.rba.gov.au/statistics/frequency/financial-aggregates.html . Access 14/5/12