The gross society – Richard Heinberg

This essay originally appeared within Pacific Standard Magazine

Seeing only its title, a prospective reader might guess this essay is about our nation’s epidemic of obesity. Or could it be a sarcastic observation on the evolution of Lyndon Johnson’s Great Society? Might it be a jeremiad about the gross (i.e., offensive and disgusting) ways we waste and over- consume natural resources, or a comment on current television trends? There’s plenty to be said on all those scores.

No, the definition of gross I have in mind is “exclusive of deductions,” as in gross profits versus net profits. The profits we’ll be considering come in the forms not just of money but, more crucially, of energy. Sound boring? Well, you may be surprised.

Here’s my thesis: As a society, we are entering the early stages of energy impoverishment. It’s hard to overstate just how serious a threat this is to every aspect of our current way of life. But the problem is hidden from view by gross oil and natural gas production numbers that look and feel just fine – good enough to crow about.

President Obama did some crowing in his most recent State of the Union address, where he touted “More oil produced at home than we buy from the rest of the world – the first time that’s happened in nearly twenty years.” It’s true: US crude oil production has increased from about 5 million barrels per day to nearly 7.75 mb/d in the past five years (we still import over 7.5 mb/d). And American natural gas production is at an all-time high. Energy problem? What energy problem?

While these gross numbers appear splendid, when you look at net things go pear-shaped, as the British say.

Our economy is 100 percent dependent on energy: with more and cheaper energy, the economy booms; with less and costlier energy, the economy wilts. When the electricity grid goes down or the gasoline pumps run dry, the economy simply stops in its tracks.

But the situation is actually a bit more complicated, because it takes energy to get energy. It takes diesel fuel to drill oil wells; it takes electricity to build solar panels. The surplus energy – once we have fueled energy production – makes possible all the things people want and need to do. It’s net energy, not gross energy, that does society’s work.

Before the advent of fossil fuels, agriculture was our main energy source, and the average net gain from the work of energy production was minimal. Farmers grew food for people – who did a lot of manual work in those days – and also for horses and oxen, whose muscles provided motive power for farm machinery and for land trans- port via carts and carriages. Because margins were small, most people had to toil in the fields in order to produce enough surplus to enable a small minority of folks to live in towns and specialize in arts and crafts (including statecraft and soldiery).

In contrast, the early years of the fossil fuel era saw astounding energy profits. Wildcat oil drillers could invest a few thousand dollars in equipment and drilling leases and, if they struck black gold, become millionaires almost overnight. If you want a taste of what that was like, watch the classic 1940 film Boom Town, with Clark Gable and Claudette Colbert.

Huge energy returns on both energy and financial investments in drilling made the fossil fuel revolution the biggest event in economic history. Suddenly society was awash with surplus energy. Cheap energy plus a little invention yielded mechanization. Farming became an increasingly mechanized (i.e., fossil-fueled) occupation, which meant fewer field laborers were needed. People left farms and moved to cities, where they got jobs on powered assembly lines manufacturing an explosively expanding array of consumer goods, including labor-saving (i.e., energy- consuming) home machinery like electric vacuum cleaners and clothes washers. Household machines helped free women to participate in the work force. The middle class mushroomed. Little Henry and Henrietta, whose grandparents spent their lives plowing, harvesting, cooking, and cleaning, could now contemplate careers as biologists, sculptors, heart specialists, bankers, concert violinists, professors of medieval French literature – what- ever! Human ambition and aspiration appeared to know no bounds.

Unfortunately, there are a couple of problems with fossil fuels. The first is that they cause climate change and thereby cast a pall over the prospects of civilized human existence on planet Earth – but let’s set that irritating thought aside for a moment. The other problem is that these fuels are finite in quantity and of variable quality; we have extracted them using the low- hanging fruit principle, going after the highest quality, cheapest-to-produce oil, coal, and natural gas first, and leaving the lower quality, more expensive, and harder-to-extract fuels for later. Now, it’s later.

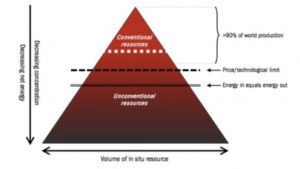

It’s helpful to visualize this best-first principle by way of a diagram of what geologists call the resource pyramid. Extractive industries typically start at the top of the pyramid and work their way down (see fig 1). This was the case historically when coal miners at the beginning of the industrial revolution exploited only the very best coal seams, and it’s also true today as drillers in the Bakken oil play in North Dakota concentrate their efforts in core areas within that play where per-well production rates are highest.

We’ll never run out of any fossil fuel, in the sense of extracting every last molecule of coal, oil, or gas. Long before we get to that point, we will confront the dreaded double line in the diagram, labeled “energy in = energy out.” At that stage, it will cost as much energy to find, pump, transport, and process a barrel of oil as the oil’s refined products will yield when burned in even the most perfectly efficient engine (I use oil merely as the most apt example; the same principle applies for coal, natural gas, or any other fossil fuel).

As we approach the energy break-even point, we can expect the requirement for ever-higher levels of investment in exploration and production on the part of the petroleum industry; we can therefore anticipate higher prices for finished fuels. Incidentally, we can also expect more environmental risk and damage from the process of fuel “production” (i.e., extraction and processing), because we will be drilling deeper and going to the ends of the Earth to find the last remaining deposits, and we will be burning ever- dirtier fuels.

Right now that’s exactly what is happening.

While America’s current gross oil production numbers appear rosy, from an energy accounting perspective the figures are frightening: energy profit margins are declining fast.

Each year, a greater percentage of US oil production comes from unconventional sources—primarily tight oil and deepwater oil. Compared to conventional oil from most onshore, vertical wells, these sources demand much higher capital investment per barrel produced. Tight oil wells typically require directional drilling and hydraulic fracturing (“fracking”), which take lots of money and energy (not to mention water); initial production rates per well are modest, and production from each

well tends to decline quickly. Therefore more wells have to be drilled continually in order to maintain a constant rate of flow. This has been called the “Red Queen” syndrome, after a passage in Lewis Carroll’s Through the Looking Glass. In the story, the fictional Red Queen runs at top speed but never gets anywhere; she explains to Alice, “It takes all the running you can do, to keep in the same place.”

Similarly, it will soon take all the drilling the industry can do just to keep production in the fracking fields steady. But the plateau won’t last long; as the best drilling areas become saturated with wells and companies are forced toward the periphery of fuel-bearing geological formations, costs will rise and production will fall. When, exactly, will the decline begin? Probably before the end of this decade.

Deepwater production is expensive too: it involves operating in miles of ocean water on giant drilling and production rigs. Deepwater drilling is also both environmentally and financially risky, as BP discovered in 2010 in the Gulf of Mexico.

Canada’s tar sands require special energy-intensive processing in order to yield usable fuels. Unless oil prices remain at current stratospheric levels, significant expansion of tar sands operations may be uneconomic.

America is turning increasingly to unconventional oil because conventional sources of petroleum are drying up. The United States is where the oil business started and, in the past century-and-a-half, more oil wells have been drilled here than in the rest of the world’s countries put together. In terms of our resource pyramid diagram, the United States has drilled through the top “conventional resources” triangle and down to the thick dotted line labeled “price / technology limit.” At this point, significantly new technology is required to extract more oil (of which there is plenty – just look how much of the total pyramid is left!), and this comes at a higher financial cost not just to the industry, but ultimately to society as a whole. Yet society cannot afford oil that’s arbitrarily expensive:

the “price / technology limit” is moveable up to a point, but we may be reaching the frontiers of affordability.

Lower energy profits from unconventional oil inevitably show up in the financials of oil companies. Between 1998 and 2005, the industry invested $1.5 trillion in exploration and production, and this investment yielded 8.6 million barrels per day in additional world oil production. But between 2005 and 2013, the industry spent $4 trillion on E&P, yet this more-than- doubled investment produced only 4 mb/d in added production.

It gets worse: all net new production during the 2005-2013 period was from unconventional sources (primarily tight oil from the US and tar sands from Canada); of the $4 trillion spent since 2005, it took $350 billion to achieve a bump in their production. Subtracting unconventionals from the total, world oil production actually fell by about a million barrels a day during these years. That means the oil industry spent over $3.5 trillion to achieve a decline in overall conventional production.

Last year was one of the worst ever for new discoveries, and companies are cutting exploration budgets (if there’s nothing worth finding, why waste money?). A recent Reuters article quoted Tim Dodson, the exploration chief of Statoil, the world’s top conventional explorer: “It is becoming increasingly difficult to find new oil and gas, and in particular new oil. . . . The discoveries tend to be somewhat smaller, more complex, more remote, so it is very difficult to see a reversal of that trend … The industry at large will probably struggle going forward with reserve replacement.”

Here is how energy analyst Mark Lewis and US Army lieutenant colonel Daniel L. Davis described the situation in a recent article in the Financial Times: “The 2013 [World Energy Outlook, published by the International Energy Agency] has the oil industry’s upstream [capital expenditure] rising by nearly 180 per cent since 2000, but the global oil supply (adjusted for energy content) by only 14 per cent. The most straightforward interpretation of this data is that the economics of oil have become completely dislocated from historic norms since 2000 (and espec- ially since 2005), with the industry investing at exponentially higher rates for increasingly small incremental yields of energy.”

The squeeze is also being felt by the global economy, which has sputtered ever since oil prices began their steep march up to the “new normal” of $100 per barrel (more about this below).

The costs of oil exploration and produc- tion are currently rising at about 10.9 percent per year, according to Steve Kopits of the energy analytics firm Douglas-Westwood. This is squeezing the industry’s profit margins, since it’s getting ever harder to pass these costs on to consumers.

In 2010, The Economist magazine discussed rising costs of energy production, musing that “the direction of change seems clear. If the world were a giant company, its return on capital would be falling.”.

Tim Morgan, formerly of the London- based brokerage Tullett Prebon (whose customers consist primarily of invest- ment banks), explored the averaged Energy Return on Energy Investment (EROEI) of global energy sources in one of his company’s Strategy Insights reports, noting: “For 2020, our projected EROEI (of 11.5:1) [would] mean that the share of GDP absorbed by energy costs would have escalated to about 9.6 percent from around 6.7 percent today. Our projections further suggest that energy costs could absorb almost 15 percent of GDP (at an EROEI of 7.7:1) by 2030. . . . [T]he critical relationship between energy production and the energy cost of extraction is now deteriorating so rapidly that the economy as we have known it for more than two centuries is beginning to unravel.”

From an energy accounting perspective, the situation is in one respect actually worst in North America – which is deeply ironic: it is here that production has grown most in the past five years, and it’s here that the industry is most boastful of its achieve- ments. Yet the average energy profit ratio for US oil production has fallen from 100:1 to 10:1, and the downward trend is accelerating as more and more oil comes from tight deposits (shale) and deepwater. Canada’s prospects are perhaps even more dismal than those of the US: the tar sands of Alberta have an energy-returned-on- energy-invested

ratio that ranges from 3.2:1 to 5:1. A five-to-one profit ratio might be spectacular in the financial world, but in energy terms this is alarming.

Everything we do in industrial societies – education, health care, research, manufacturing, transportation – uses energy. Unless our investment of energy in producing more energy yields an averaged profit ratio of roughly 10:1 or more, it may not be possible to maintain an industrial (as opposed to an agrarian) mode of societal organization over the long run.

None of the unconventional sources that the petroleum industry is turning toward (tight oil, tar sands, deepwater) would have been developed absent the context of high oil prices, which deliver more revenue to oil companies; it’s those revenues that fund ever-bigger investments in technology.

But older industrial economies like the US and EU tend to stall out if oil costs too much, and that reduces energy demand; this “demand destruction” safety valve has (so far) set a limit on global petroleum prices. Yet for the major oil companies, prices are currently not high enough to pay for the development of new projects in the Arctic or in ultra-deepwater; this is another reason the majors are cutting back on exploration investments.

For everyone else, though, oil prices are plenty high. Soaring fuel prices wallop airlines, the tourism industry, and farmers. Even real estate prices can be impacted: as gasoline gets more expensive, the lure of distant suburbs for prospective homebuyers wanes. It’s more than mere coincidence that the US housing bubble burst in 2008 just as oil prices hit their all- time high.

Rising gasoline prices (since 2005) have led to a reduction in the average number of miles traveled by US vehicles annually, a trend toward less driving by young people, and efforts on the part of the auto industry to produce more fuel-efficient vehicles. Altogether, American oil consumption is today roughly 20 percent below what it would have been if growth trends in the previous decades had continued.

To people concerned about climate change, much of this sounds like good news. Oil companies’ spending is up but profits are down. Gasoline is more expensive and consumption has declined. Hooray!

There’s just one catch. None of this is happening as a result of long-range, comprehensive planning. And it will take a lot of planning and effort to minimize the human impact of a societal shift from relative energy abundance to relative energy scarcity. In fact, there is virtually no discussion occurring among officials about the larger economic implications of declining energy returns on investment.

Indeed, rather than soberly assessing the situation and its imminent economic challenges, our policy makers are stuck in a state of public relations-induced euphoria, high on temporarily spiking gross US oil and gas production numbers.

The obvious solution to declining fossil fuel returns on investment is to transit- ion to alternative energy sources as quickly as possible. We’ll have to do this anyway to address the climate crisis. But from an energy accounting point of view, this may not offer much help. Renewable energy sources like solar and wind have characteristics very different from those of fossil fuels: the former are intermittent, while the latter are available on demand.

Solar and wind can’t affordably power airliners or 18-wheel trucks. Moreover, many renewable energy sources have a relatively low energy profit ratio.

One of the indicators of low or declining energy returns on energy investment is a greater requirement for human labor in the energy production process. In an economy suffering from high unemployment, this may seem like a boon.

Indeed, here is an article that touts solar energy as job creator, employ- ing more people than the coal and oil industries put together (even though it produces far less energy for society). Yes, jobs are good. But what would happen if we went all the way back to the average energy returns-on- investment of agrarian times?

There’d certainly be plenty of work needing to be done. But we would be living in a society very different from the one we are accustomed to, one in which most people are full-time energy producers and society is able to support relatively few specialists in other activities. Granted, that’s probab- ly an exaggeration of our real prospects

— at least some renewable energy sources can give us higher returns than were common in the agrarian era. However, they won’t power a rerun of Dallas. This will be a simpler, slower, and poorer economy.

If our economy runs on energy, and our energy prospects are gloomy, how is it that the economy is recovering?

The simplest answer is, it’s not – except as measured by a few misleading gross statistics. Each month the Bureau of Labor Statistics releases figures for new jobs created, and the numbers

look relatively good at first glance (175,000 net new jobs for February 2014). But most of these new jobs pay less than jobs that were lost in recent years. And unemployment statistics don’t include people who’ve given up looking for work. Labor force participation rates are at the lowest level in 35 years.

All told, according to a recent Gallup poll, more Americans say they are worse off today than they were a year ago (as opposed to those who say their situation has improved).

Claims of economic recovery fixate primarily on one number: Gross Domestic Product, or GDP. That number is going up, albeit at an anemic pace in comparison with rates common in the 20th century; hence, the economy is said to be growing. But what does this really mean? When GDP rises, that indicates more money is flowing through the economy. Typically, a higher GDP equates to more consumption of goods and services, and therefore more jobs. What’s not to like about that?

A couple of things. First, there are ways of making GDP grow that don’t actually improve people’s lives. Economist Herman Daly calls this “uneconomic growth.” For example, if we spend money on rebuilding after a natural disaster, or on prisons or armaments or cancer treatment, GDP rises. But who wants more natural disasters, crime, wars, or cancer? Historically, the burning of ever more fossil fuels was closely tied to GDP expansion, but now we face the prospect of devastating climate change if we continue increasing our burn rate. To the extent GDP growth is based on fossil fuel consumption, when GDP goes up we’re

actually worse off because of it. Altogether, Gross Domestic Product does a really bad job of capturing how our economy is doing on a net basis. In fact, Daly figures that just about all our current GDP growth is uneconomic.

Second, a growing money supply (which is implied by GDP growth) depends upon the expansion of credit; another way to say this is: a rising GDP (in any country with a floating exchange rate) entails increasing levels of outstanding debt. Historical statistics bear this out. But is any society able to expand its debt endlessly?

If there were indeed limits to a country’s ability to perpetually grow GDP by increasing its total debt (government plus private), a warning sign would likely come in the form of a trend toward diminishing GDP returns on each new unit of credit created.

Bingo: that’s exactly what we’ve been seeing in the US in recent years. Back in the 1960s, each dollar of increase in total US debt was reflected in nearly a dollar of rise in GDP. By 2000, each new dollar of debt corresponded with only $.20 of GDP growth. The trend line will reach zero in about 2016.

Meanwhile, it seems that Americans have taken on about as much household debt as they can manage, as rates of consumer borrowing have been stuck in neutral since the start of the Great Recession. To keep total debt growing (and the economy expanding, if only statistically), the Federal Reserve has kept interest rates low by creating up to $85 billion per month through a mere adjustment of its ledgers (yes, it can do that); it uses the money to buy Treasury bills (US government debt) from Wall Street

banks. When interest rates are low, people find it easier to buy houses and cars (hence the recent rise in house prices and the auto industry’s rebound); it also makes it cheaper for the government to borrow – and, in case you haven’t noticed, the federal government has borrowed a lot lately.

The Fed’s Quantitative Easing (QE) program props up the banks, the auto companies, the housing market, and the Treasury. But, with overall consumer spending still anemic, the trillions of dollars the Fed has created have generally not been loaned out to households and small businesses; instead, they’ve simply pooled up in the big banks. This is money that’s constantly prowling for significant financial returns, nearly all of which go to the “one percenters.” Fed policy has thus generated a stock market bubble, as well as a bubble of investments in emerging markets, and these can only continue to inflate for as long as QE persists.

The obvious way to keep these bubbles from growing and eventually bursting (with attendant financial toxicity spilling over into the rest of the economy) is to stop QE. But doing that will undermine the “recovery,” such as it is, and might even send the economy careening into depression. The Fed’s solution to this “damned if you do, damned if you don’t” quandary is to “taper” QE, reducing it gradually over time. However, this doesn’t really solve anything; it’s just a way to delay and pretend.

With money as with energy, we are doing extremely well at keeping up appearances by characterizing our situation with a few cherry-picked numbers. But behind the jolly statistics lurks a menacing reality. Collectively, we’re like a dietician who has adopted the attitude: the more you weigh, the healthier you are! How gross would that be?

The world is changing. Cheap, high- EROEI energy and genuine economic growth are disappearing. Rather than recognizing the fact, we hide it from ourselves with misleading figures. All that this accomplishes is to make it harder to adapt to our new reality.

The irony is, if we recognized the trends and did a little planning, there could be an upside to all of this. We’ve become over-specialized anyway. We teach our kids to operate machines so sophisticated that almost no one can build one from scratch, but not how to cook, sew, repair broken tools, or grow food. We seem to be less happy year by year. We’re overcrowded, and continuing population growth only makes matters worse. Why not encourage family planning instead?

Studies suggest we could dial back on consumption and be more satisfied with our lives.

What would the world look and feel like if mankind deliberately and intelligently nudged the brakes on material consumption, reduced our energy throughput, and re-learned some general skills?

Quite a few people have already done the relevant experiment. Take a virtual tour of Dancing Rabbit ecovillage in northeast Missouri here, or Lakabe in northern Spain here. But you don’t have to move to an ecovillage to join in the fun; thousands of Transition initiatives exist worldwide running essentially the same experiment in ordinary towns and cities, just not so intensively. Take a look at www.Resilience.org any day of the week to see reports on these experiments, or tips on what you could do to adapt more successfully to our new economic reality.

All of these efforts have a couple of things in common: first, they entail a lot of hard work and (according to what I hear) yield considerable satisfaction.

Second, they are self-organized and self-directed, not funded or overseen by government. The latter point is crucial – not because government is inherently wicked, but because it’s just not likely to be of much help in present circumstances. That’s because our political system is currently too broken to grasp the nature of the problems facing us.

Which is unfortunate, because even a little large-scale planning and support could help; without it, we can be sure the transition will be more chaotic than necessary, and a lot of people will be hurt needlessly.

Quite simply, we must learn to be successfully and happily poorer. For people in wealthy industrialized countries, this requires a major adjustment in thinking. When it comes to energy, we have deluded ourselves into believing that gross is the same as net. In the early days of fossil fuels, it very nearly was. But now we have to go back to thinking the way people did when energy profit margins were smaller. We must learn to operate within budgets and limits.

This means decentralization, simplification, and localization. Becoming less reliant on long-term debt, paying as we go. It means living closer to the ground, learning general skills, and keeping a hand in basic productive activities like growing food.

Think of our future as the Lean Society. We can make this transition success- fully, if not happily, if enough of us embrace Lean Society thinking and habits. But things likely won’t go well at all if we continue to hide reality from ourselves with gross numbers that delay our adaptation to accelerating, inevitable trends.

Source: Richard Heinberg Museletter #263 http://richardheinberg.com/museletter-263-the-gross-society