Income inequality in the United States

To the victor belong the spoils

David Ruccio

The following is extracted from an article by Prof David Ruccio entitled “To the victor belong the spoils”, which appeared in Real World Economic Review Blogs on 22 August 2020 [1].

The phrase “To the victor belong the spoils”, used in the early 19th century to describe a spoils system of appointing government workers, describes accurately the American economy today*. It is pretty clear who the victor is, and it’s not the working population.

Instead, a small group at the top have come out as the victor – and that’s been true for decades now.

How do we know?

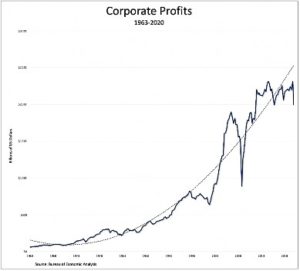

Well, all we have to do is look at the growing gap between the amount produced by American workers and what they received in their wages. Gross Domestic Product grew by a factor of almost 16 from 1973 onward while workers’ wages increased by a bit more than 5 before the COVID Depression.

So, American workers have received back in the form of wages only a small percentage of the increased amount they produced. The rest went to their employers.

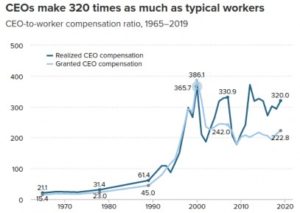

The result has been an enormous rise in U.S. corporate profits (before tax, without inventory valuation and capital consumption adjustments). Particularly evident in the trendline fitted to the data shown in Fig 1. The employers, in turn, transferred a portion of those profits to the Chief Executive Officers of their corporations as depicted in Fig 2.

[su_spacer size=”10″]

According to the latest report produced by the Economic Policy Institute, in 2019, a CEO at one of the top 350 firms in the United States was paid $21.3 million on average (using a “realized” measure of CEO pay that counts stock awards when vested and stock options when cashed in — rather than when granted). The ratio of CEO-to-typical-worker compensation was therefore about 320-to-1 (222.8-to- 1 using a different, “granted” measure of CEO pay). That is up from 293-to-1 in 2018 and a gigantic increase from 61.4-to-1 in 1989 and, even more, 21.1- to-1 in 1965.

Exorbitant CEO pay is a major contributor to rising inequality that we could safely do away with. CEOs are getting more because of their power to set pay — and because so much of their pay (about three-fourths) is stock-related, not because they are increasing productivity or have specific, high-demand skills.

This escalation of CEO compensation, and of executive compensation more generally, has fuelled the growth of top 1.0% and top 0.1% incomes, leaving less of the fruits of economic growth for ordinary workers and widening the gap between very high earners and the bottom 90%. The economy would suffer no harm if CEOs were paid less (or were taxed more).

An even larger – and growing – distribution of the surplus that forms the basis of corporate profits has taken the form of dividends, paid to owners of corporate equities. In 1965, dividends were about 26 (25.8) percent of corporate profits; by the beginning of this year they were almost 70 (69.2) percent.

And according to my calculations, the top 1 percent in the United States owns (as of 2014, the last year for which data are available) 62 percent of corporate equities, which has been climbing since the late 1970s. Meanwhile, the share of the entire bottom 90 percent has been falling, and is now only 11 percent.

So, it’s really only the small group at the top that is in a position to “share in the booty” by receiving a cut of corporate profits in the form of CEO pay and stock dividends. They’ve occupied the posit- ion of victor for decades now, and to them belong the economic spoils.**

Everyone else is forced to have the freedom to try to get by on their slowly rising wages—and to watch with both fascination and horror the ongoing spectacles in corporate boardrooms and the stock market.

* ‘To the victor belong the spoils’ is attributed to Senator William Learned Marcy of New York, who in 1832 def- ended Andrew Jackson, whose political campaign against the president John Quincy Adams was seen partly as a vendetta against Adams, and whose conduct and remarks when taking office seemed to justify the association of Jackson with the spoils system.

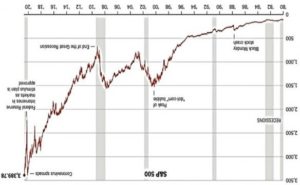

** On 21 August 2020, in the midst of the pandemic and the worst economic downturn since the Great Depression of the 1930s, the U.S. stock market reach- ed a new high (according to Standard & Poor’s 500 index). See Fig 3.

1. Source: Real World Econ Rev Blogs, 22 Aug 2020 https://rwer.wordpress.com/2020/08/22/to-the-victor-belong-the-spoils/

Comment from Alonso Kihano

I would like to look at the same problem from a more general point of view. Looking for household debt I found data from the IMF DataMapper. showing household debt as a percent of GDP for many countries. Surprisingly, the households in developed countries have much higher debt than less developed or underdeveloped countries. That is highly perplexing. The more the country produces, the higher productivity, the higher GDP per capita – the higher the household debt. It looks as the more you produce the more indebted you are. How this happens? It looks as if the society cannot buy the products and services it produces. This speaks of a very mismanaged price-income system.

All is cheap for the few top incomes and all is expensive for low incomes. Prices are systematically higher than most people can afford. Therefor market equilibrium is either absent or is highly distorted by credits.