Chicago economics: a dangerous pseudo-scientific zombie

Lars Syll

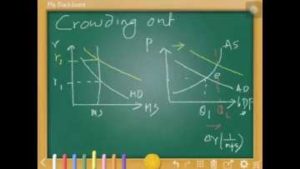

The “crowding out of loanable funds” hypothesis is largely spurious and misconceived, as can be shown by proper studies of government borrowing and deficit spending, monetary flows within the private sector, and banking practices.

According to US mainstream economist John Cochrane: “Every dollar of increased government spending must correspond to one less dollar of private spending. Jobs created by stimulus spending are offset by jobs lost from the decline in private spending. We can build roads instead of factories, but fiscal stimulus can’t help us to build more of both. This form of “crowding out” is just accounting, and doesn’t rest on any perceptions or behavioural assumptions.”

According to US mainstream economist John Cochrane: “Every dollar of increased government spending must correspond to one less dollar of private spending. Jobs created by stimulus spending are offset by jobs lost from the decline in private spending. We can build roads instead of factories, but fiscal stimulus can’t help us to build more of both. This form of “crowding out” is just accounting, and doesn’t rest on any perceptions or behavioural assumptions.”

What Cochrane is reiterating here is nothing but Say’s law, basically saying that savings are equal to investments, and that if the state increases investments, then private investments have to come down (‘crowding out’).

According to this narrative, government borrowing is supposed to “crowd out” private investment. However according to economist William Vickrey in his paper “Fifteen Fatal Fallacies of Financial Fundamentalism” [1]:

” On the contrary, the current reality is that the expenditure of [money associated with] the borrowed funds – unlike that of tax revenues – will generate added disposable income, enhance the demand for the products of private industry, and make private investment more profitable. As long as there are plenty of idle resources lying around, and monetary authorities behave sensibly (instead of trying to counter the supposedly inflationary effect of the deficit), those with a prospect for profitable investment can be enabled to obtain financing. Under these circumstances, each additional dollar of the deficit will – in the medium long run – generate two or more additional dollars of private investment. The capital created is an increment to someone’s wealth and ipso facto someone’s saving. The dictum “supply creates its own demand” fails as soon as some of the income generated by the supply is saved, but investment does create its own saving, and more. Any crowding out that may occur is the result, not of underlying economic reality, but of inappropriate restrictive reactions on the part of a monetary authority in response to the deficit. ”

A couple of years ago, in a lecture on the US recession, Robert Lucas gave an outline of what the new classical school of macroeconomics today thinks on the latest downturns in the US economy and its future prospects.

Lucas starts by showing that real US GDP has grown at an average yearly rate of 3 per cent since 1870, with one big dip during the Depression of the 1930s and a big – but smaller – dip in the recent recession.

[su_spacer size=”10″]

After stating his view that the recession that started in the US in 2008 was basically caused by a run for liquidity, Lucas then goes on to discuss the prospect of recovery from where the US economy is today, maintaining that past experience suggests an “automatic” recovery, if the free market system is left to repair itself to equilibrium unimpeded by social welfare activities of the government.

As could be expected there is no room for any Keynesian type considerations for addressing the eventual shortages of aggregate demand which will inhibit the recovery of the economy. No, as usual in the new classical macroeconomic school’s explanations and prescriptions, the blame game points to the government and its lack of supply side policies.

Lucas is convinced that what might arrest the recovery are higher taxes on the rich, greater government involvement in the medical sector and tougher regulations of the financial sector. But – if left to run its course unimpeded by European type welfare state activities – the free market will fix it all.

In a rather cavalier manner – without a hint of argument or presentation of empirical facts – Lucas dismisses even the possibility of a shortfall of demand. For someone who 30 years ago proclaimed Keynesianism dead – “people don’t take Keynesian theorizing seriously anymore; the audience starts to whisper and giggle to one another” – this is of course only what could be expected. Demand considerations are ruled out on whimsical theoretical-ideological grounds, much like we have seen other neoliberal economists do over and over again in their attempts to explain away the fact that the latest economic crises shows how the markets have failed to deliver. If there is a problem with the economy, the true cause has to be government.

Chicago economics is a dangerous pseudo-scientific zombie ideology that ultimately relies on the poor having to pay for the mistakes of the rich. Trying to explain business cycles in terms of rational expectations has blatantly failed. Maybe it would be asking too much of fresh- water economists like Lucas and Cochrane to concede that, but it’s still a fact that ought to be embarrassing.

My rational expectation is that thirty years from now, no one will know anything about Robert Lucas or John Cochrane. John Maynard Keynes, on the other hand, will still be known as one of the masters of economics.

According to British economist G.L.S. Shackle: ” If at some time my skeleton should come to be used by a teacher of osteology to illustrate his lectures, will his students seek to infer my capacities for thinking, feeling, and deciding from a study of my bones? If they do, and any report of their proceedings should reach the Elysian Fields, I shall be much distressed, for they will be using a model which entirely ignores the greater number of relevant variables, and all of the important ones. Yet this is what ‘rational expectations’ does to economics. ”

1. http://www.columbia.edu/dlc/wp/econ/vickrey.html

Source: Real World Econ Rev, 31 May 2017 https://rwer.wordpress.com/2017/05/31/chicago-economics-a-dangerous-pseudo-scientific-zombie/